Integrating news into a GRC system makes a lot of sense. News media is a reliable source of information, updated constantly, at enormous scale, which provides critical real-time information and insights to enhance early identification, in-depth assessment, and proactive monitoring across the entire risk landscape. This includes operational risk, regulatory risk, third-party risk, credit risk, ESG risk, amongst others.

The need for news in GRC

News is not just a nice to have; it is becoming a must have. From a regulatory and compliance perspective, there are a range of international and national regulatory requirements and recommendations referencing news, including:

- The FATF "recommends carrying out additional searches (e.g., verifiable adverse media searches) to inform the individual customer risk assessment "- FATF: Risk-based approach guidance for the banking sector

- 4AMLD includes a requirement for screening against “open source” media, such as “reports in reputable newspapers”, as part of the EDD process. - 4th AMLD

- Negative news screening forms "an integral element in constructing and identifying potential risks" - The Wolfsberg Group: FAQs on Negative News Screening

- "Senior management should ensure that the bank’s IT strategy includes ways to improve risk data aggregation capabilities." - Basel Framework SRP36

- Banks should be using open-source websites to gain a better understanding of the customer or beneficial owner, their reputation and their role in public life - FCA, FCTR 16

Integrating news is a difficult process

Unfortunately, utilizing news in risk management is a difficult process, where the following issues have to be considered.

- Access to news: Accessing news content for use in effective monitoring processes requires significant investment in commercial partnerships (negotiating and maintaining licenses) and technical expertise to ingest the news content into your system.

- Complexity and scale: News is published at an astonishingly large scale every day making it inherently difficult to harness and utilize. It is also an unstructured data format, which increases the complexity for technology to automate processes.

- Finding what matters: Relying on traditional keyword-based search and monitoring techniques results in significant amounts of false positives. The inefficiency and ineffectiveness of relying solely on keywords results in missed risks.

- Extracting insight: Identifying risk signals from news data in a timely and effective manner is not an easy task. It requires advanced analytics and intelligent automation capabilities.

- Technical barriers: Ensuring that data and insights uncovered in risk monitoring processes is used effectively and not lost in siloes also requires significant tech investment.

- Operationalizing the data: Surfacing the data and insight in analyst facing apps, decisioning models, or business reports can be extremely challenging for most organizations.

The need for an AI-powered News API

This is where the cutting-edge technology of an AI-powered News API is required to increase accuracy, efficiency, and effectiveness. The barriers listed above are all overcome by implementing a solution like Quantexa News APIs, which uses state-of-the-art machine learning and natural language processing (NLP) to transform unstructured news articles into structured news data, which enables far greater accuracy and effectiveness when using news for risk identification, assessment, and monitoring.

- Aggregate: Quantexa News API will expand your monitoring reach by providing instant access to over 90,000 global news sources, with around 1.3 million news articles per day, in 15 languages, across the open Web and licensed publishers. That means no licenses need to be negotiated, and scrapers need to be built or maintained. Furthermore, all articles are available in their native language, as well as translation into English.

- Filter: Finding what matters and filtering out the noise is where Quantexa really outperforms alternative News APIs. Our entity-based search recognises over 5.6 million entities (people, companies, products, places etc), and provides entity-level sentiment analysis for each entity in every article. Every article is also tagged with relevant categories using Quantexa’s Smart Tagger taxonomy of over 3,000 topical categories and 1,500 industries. Our granular taxonomy is the most powerful categorization tool on the market, enabling you to cut out noise without missing crucial signals.

- Investigate: Once you have searched for relevant news and filtered out the noise, Quantexa News API provides you with the tools needed to investigate and assess risk with the required context. This includes time series charts to look for spikes in news volume, and trend analysis charts which provide insight on common entities, categories, and keywords. Our event clustering groups similar articles together for easier event detection, as well as article deduplication and event deep-dives.

- Integrate: Surfaced news content, signals, and insights are only valuable if they are operationalized. The news data provided as output from News API is cleansed JSON that is ready for use in news feeds in applications (as well as machine learning models).

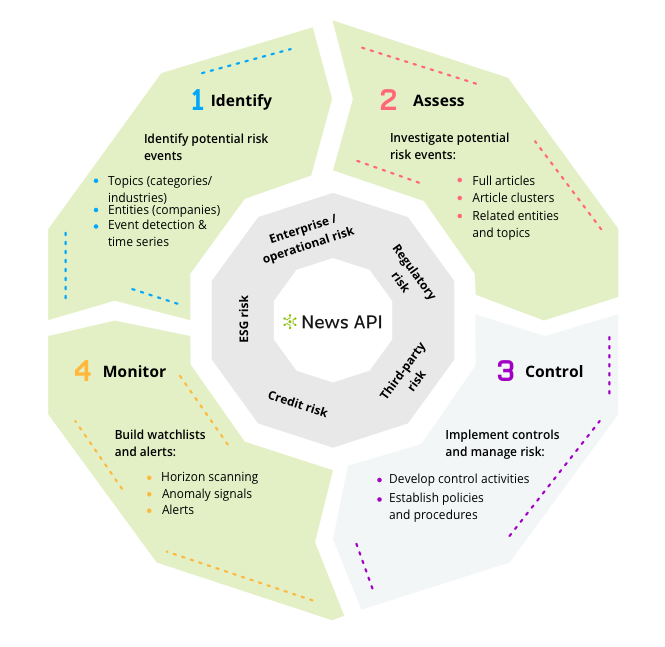

News in the risk management lifecycle

Now that you have the capabilities to harness the power of global news, it should be an integral component throughout the risk management lifecycle, where it can be applied to multiple stages:

- Identify: Identify risks as they are happening through the combination of powerful queries using specific entities and categories, and identification tools such as event detection and time series spikes.

- Assess: Once a risk has been identified, the risk needs to be assessed. Use investigation tools such as event clustering to investigate groups of similar articles for the full story. Investigate further using Quantexa’s trends feature to find the most commonly associated entities, categories, and keywords.

- Control: Once a risk has been assessed, implement controls and manage the risk, by developing control activities and establishing policies and procedures.

- Monitor: Proactive monitoring is made possible with Quantexa News API. Build watchlists and real-time feeds to augment horizon scanning, and use anomaly detection to uncover early warning signals.

Try Quantexa News API for free, and discover the power of an AI-powered News API for yourself. Sign up for a 14 day free trial here.

Related Content

-

General

General20 Aug, 2024

The advantage of monitoring long tail international sources for operational risk

Keith Doyle

4 Min Read

-

General

General24 Oct, 2023

Introducing Quantexa News Intelligence

Ross Hamer

5 Min Read

-

Product

Product15 Mar, 2023

Introducing an even better Quantexa News Intelligence app experience

Ross Hamer

4 Min Read

Stay Informed

From time to time, we would like to contact you about our products and services via email.